If you plan on building your own home or are planning a major renovation make appointment with us. We can explain draw calculations, budgeting for those draws, appraisal issues and guide you through these and a myriad of other potential pitfalls.

Cost to complete means that the lender always holds back enough of the approved mortgage to complete the project. This calculation can create a lot of problems for inexperienced owner builders who miscalculate the draws and end up in a budget shortfall. Basically, the lower the loan amount in relation to the actual cost of the build, the bigger the holdback. Just because you’re at 45% complete does not mean you will get 45% of the approved loan amount.

For example, if you have a 500,ooo draw mortgage approval and you have a construction budget of $600,000.00. If your first draw is at lockup (typically 45% complete) then your first draw would be $500,000 minus the cost to complete which is 55% of $600,000 ($330,000). This means your first draw would be $170,000 less any earlier loan amount advanced.

So you can see the potential issue, you’ve spent 45% of $600,000 ($270,000) but only get $170,000. The 100K shortfall can be a nasty surprise if you’re not prepared. We have had this problem and many others come across our desks so the sooner you involve us the less likely it will be you will run into avoidable issues.

If you are in this situation, give us a call, we have solutions.

Over 25 years experience in construction lending, we CAN answer your concerns.

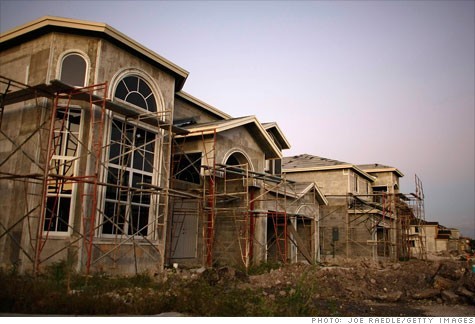

Many people dream of building their own home. Some have construction management experience and many have none. The history of lending to self-builders can be described as checkered at best. Inexperience leads to cost overruns, cash shortfalls and schedule delays. This leads to a lot of handholding and conflict, between the lender and the borrowers.

Many people dream of building their own home. Some have construction management experience and many have none. The history of lending to self-builders can be described as checkered at best. Inexperience leads to cost overruns, cash shortfalls and schedule delays. This leads to a lot of handholding and conflict, between the lender and the borrowers.